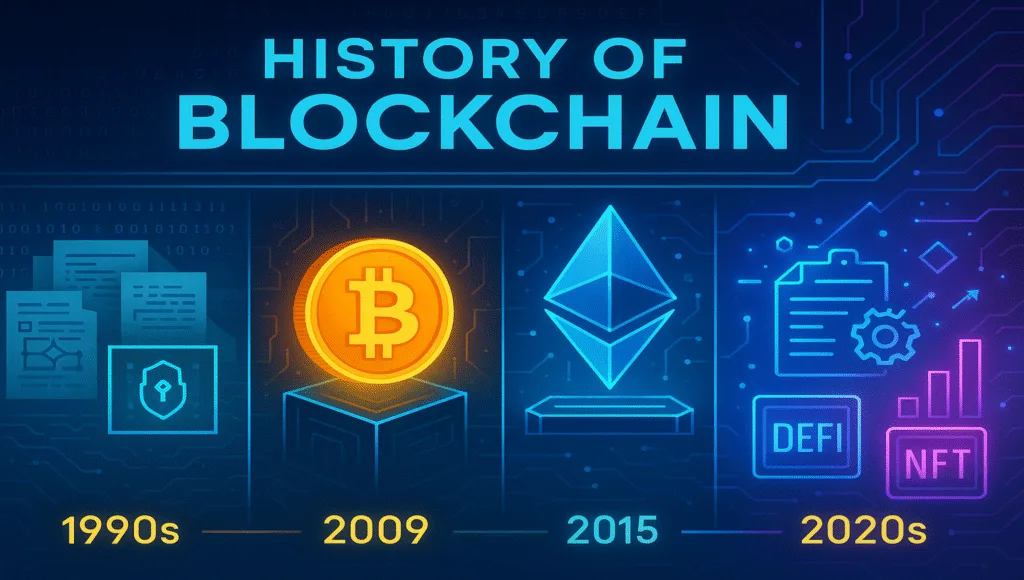

Here’s the thing: blockchain is often talked about as if it popped into existence with Bitcoin. But that misses half the story. Its ideas go way back, and its evolution has layers. Understanding where blockchain comes from helps see where it’s going!

Before Bitcoin: The roots of Blockchain

The seeds of blockchain technology were planted well before 2008. Cryptographers and computer scientists were already working on ideas to secure digital documents, prevent tampering, and enable trust without a centralized authority.

- In 1991, Stuart Haber and W. Scott Stornetta published work on chains of blocks secured by cryptography. They wanted a system where document timestamps couldn’t be altered.

- In 1992, they improved on the first design by incorporating Merkle Trees, which let you group many documents in one block, making the system more efficient.

- Leading up to 2004 and 2005, there were other related proposals and cryptographic research. For example, proof of work ideas were being explored for spam reduction, and there were early attempts to build digital cash systems. These weren’t called blockchains yet, but they laid important groundwork.

Bitcoin and the birth of blockchain (2008 to 2009)

Here’s where everything changes in practice.

- In 2008, someone (or a group) using the name Satoshi Nakamoto published the Bitcoin white paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System.” This described a system combining several ideas: cryptographic hashes, proof of work, distributed consensus, and no trusted third party.

- In January 2009, the first block, known as the Genesis Block, of the Bitcoin blockchain was mined. That launched the Bitcoin network.

- The first Bitcoin transactions followed, both among its early adopters and later, when the first real-world purchase using Bitcoin happened in 2010, famously 10,000 BTC for two pizzas.

Expansion: Smart contracts, Ethereum, Altcoins

Bitcoin was powerful but limited beyond peer-to-peer transactions of value. Then came more expressive blockchains.

- In 2013 and 2014, Vitalik Buterin proposed Ethereum. The idea was to allow programmable contracts, known as smart contracts, not just recording transfers. Ethereum was officially launched in 2015 via a public crowdsale.

- Alongside Ethereum, many alternative cryptocurrencies or altcoins appeared. Some focused on privacy, such as Monero and Zcash, others on speed or different consensus mechanisms.

Growing pains: Security, scaling, governance

Once blockchain began to be used more widely, issues showed up.

- The DAO hack in 2016 is one big example. A large project on Ethereum called The DAO was exploited, funds were stolen, and this led to a hard fork that split the chain into Ethereum and Ethereum Classic.

- Scalability became a major concern. Bitcoin’s transaction throughput is limited, and Ethereum’s too. People started proposing layer 2 solutions and different consensus methods like proof of stake.

Beyond currency: Enterprise, Regulation, DeFi, NFTs

After proving the concept, blockchain began branching out.

- Enterprises and consortia started exploring private and permissioned blockchains for use in supply chains, trade finance, and identity systems. Projects like Hyperledger, launched around 2015, were important examples.

- Regulatory frameworks began forming. Different countries started classifying cryptocurrencies, taxing them, or putting rules around exchanges.

- Decentralized Finance, or DeFi, turning finance from traditional intermediaries to protocols on blockchain, rose sharply around 2018 to 2020. Smart contracts enabled lending, borrowing, and automated market makers.

- Non-Fungible Tokens, or NFTs, became visible to mainstream audiences in 2020 and 2021. Art, collectibles, gaming, and digital ownership exploded in popularity.

Recent trends and where things stand today

Here’s where things stand more recently.

- Ethereum has been moving toward proof of stake to reduce energy use and improve scalability. This is a big technical and community shift.

- There is more focus on interoperability, meaning different blockchains talking to each other, privacy through zero-knowledge proofs, regulatory oversight, and sustainability.

- Expanded use cases are emerging in supply chains, identity, healthcare, government records, art, and gaming. Blockchain is no longer just crypto.

Why it matters and what’s next?

Blockchains promise some strong properties: transparency, immutability, and trust without centralization. But they also bring trade-offs like complexity, energy use, and regulatory risk.

Next steps look like:

- Better scaling, both technical and social.

- More legal clarity across jurisdictions.

- More usable and safe smart contracts.

- Wider adoption beyond tech early adopters.

- More attention to environmental impact.

Timeline of key events

| Year | Event | Why It’s Important |

|---|---|---|

| 1991 | Haber and Stornetta publish work on cryptographically secured chains with timestamps. | First formal design of a chain of blocks that cannot be tampered with. |

| 1992 | Incorporation of Merkle Trees into their design. | Improves efficiency and allows many documents in one block. |

| 1998 to 2004 | Various proposals, such as digital cash designs and proof of work systems. | Groundwork for dealing with double-spending, trust, and validation. |

| 2008 | Bitcoin white paper published by Satoshi Nakamoto. | First time combining these ideas into a workable system with a decentralized ledger. |

| 2009 | Genesis block mined, Bitcoin network goes live. | Real-world launch of a blockchain system. |

| 2010 | First commercial Bitcoin transaction, the pizza purchase. | Shows that crypto can have real-world exchange value. |

| 2013 to 2014 | Ethereum is proposed and smart contracts idea takes off. | Blockchain becomes more than just money, it becomes programmable. |

| 2015 | Ethereum launches, and Hyperledger project begins. | Broader ecosystems for applications and private blockchain interest grow. |

| 2016 | The DAO hack and hard fork to create Ethereum Classic. | Highlights security and governance challenges. |

| 2018 to 2020 | Rise of DeFi, NFTs, and increased regulatory attention. | Use cases multiply and public awareness grows. |

| 2020 to 2022 | Moves toward proof of stake, scaling improvements, and interoperability. | Technical evolution to address earlier limits. |

Frequently Asked Questions

No single person or company controls a public blockchain. It’s maintained by a network of participants called nodes that validate and record transactions through consensus rules.

One of the earliest uses was digital timestamping for documents, long before Bitcoin. Later, private blockchains were adopted in supply chains and trade finance.

Proof of stake reduces the energy cost of validating transactions compared to proof of work. It represents a major evolution in how blockchains achieve consensus.

Once data is recorded, altering it would require controlling most of the network’s computational or staking power, which is extremely difficult. This is why blockchain is often called tamper-resistant.

Blockchain’s history shows how decades of cryptographic ideas came together in Bitcoin and later evolved into Ethereum, DeFi, and beyond. What began as a digital cash experiment is now shaping industries far outside finance.

The journey isn’t finished. As scalability, regulation, and real-world adoption advance, blockchain will keep redefining how trust and value are exchanged globally!

With over five years of experience in the tech industry, Kazim excels at simplifying complex topics, making them accessible to tech enthusiasts and general readers alike.

He has contributed to several renowned publications worldwide, including WindowsReport and Allthings.how, bringing insightful coverage of key developments in the field.

When he’s not writing, you’ll find Kazim planning weekend getaways or diving into tech verticals beyond his expertise.