Hector Network was a DeFi project built on Fantom, featuring two main tokens: HEC (utility, governance, reserve type) and TOR (stablecoin). Its goal was ambitious: build a web3 ecosystem including staking, bonding, decentralized finance, NFTs, and more. It grew during the DeFi boom, attracted investor funds, and at one point had a treasury of over US$100 million.

The rise of Hector Network

Investors were excited by its features: staking, bonding, yield, and the promise of a stablecoin backed by assets. The project also benefited from the popularity of cross-chain activity, especially with Multichain, which allowed assets to move across blockchains. Hector’s treasury included assets held through such bridges.

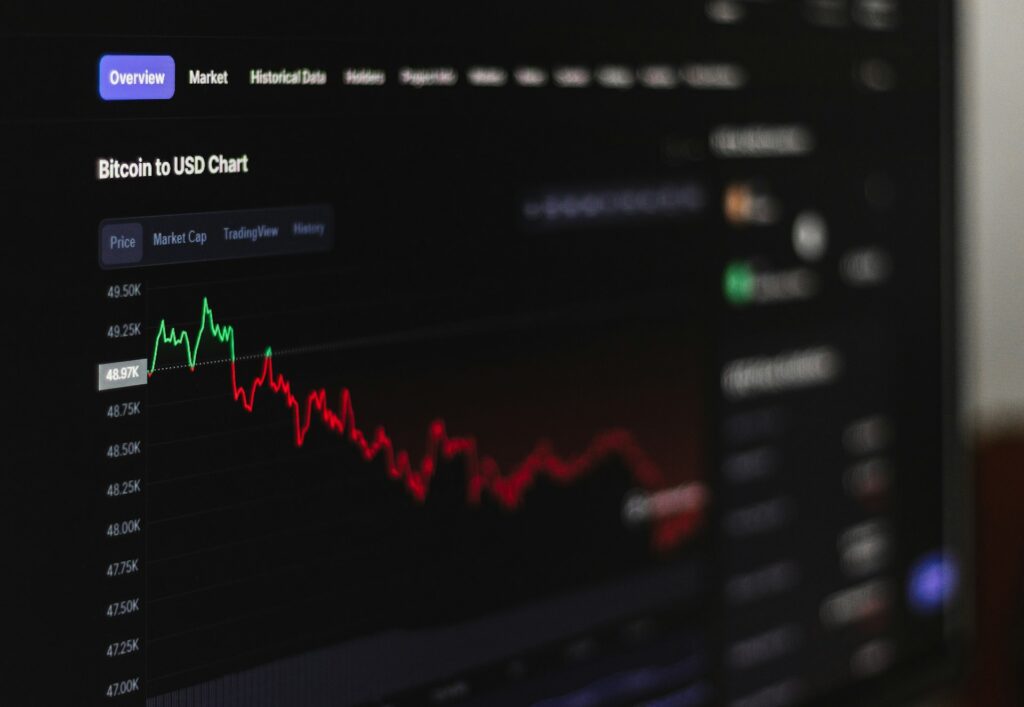

For a while, it worked. The project showed growth, community enthusiasm, a strong treasury, and an expanding ecosystem. But risks were already visible, such as large salaries, complex tokenomics, and heavy reliance on external bridges.

The Fall of Hector Network: Key Events

- Multichain collapse

On July 6, 2023, the Multichain bridge failed after its leaders were arrested in China. Hector lost about US$8 million because part of its treasury was held there. - Shrinking treasury

Even before Multichain, the treasury was falling fast. Market downturns, mismanagement, and high salaries drained funds. - Community votes to liquidate

By July 15, 2023, frustration peaked. Token holders voted 83 percent in favor of liquidation. They no longer believed the project could recover. - Delays in payouts

The liquidation plan promised redemptions for HEC holders. But the process dragged. Poor communication only added to investor anger. - Exploit during redemption

In January 2024, hackers drained US$2.7 million from the redemption contract. A function that allowed wallet whitelisting was abused. - Receivership and bankruptcy

In February 2024, a court in the British Virgin Islands appointed receivers to handle the remaining US$9 million. Then, in June 2024, Hector filed for Chapter 15 bankruptcy in the US to protect assets and deal with lawsuits.

Why did the Hector Network fail?

- Overexposure to risky bridges and external dependencies. Multichain was not Hector’s infrastructure, and when it failed, Hector lost millions.

- Governance issues and communication breakdowns. The community felt out of the loop, with concerns about treasury management and lack of transparency.

- Poor risk control in smart contracts. The redemption exploit highlighted that even audited contracts can fail if centralization risks are ignored.

- Unclear tokenomics and misaligned incentives. Large salaries and rewards for the core team clashed with investor losses when things went bad.

- Slow resolution and delays made things worse. After the liquidation vote, people expected quick payouts. Delays and muted communication only fueled suspicion.

- Legal and jurisdictional complexity. Cross-border assets meant multiple courts and legal frameworks, which added to the cost and confusion.

Timeline of Key Events

| Date | Event |

|---|---|

| Late 2021 – Early 2022 | Hector grows, treasury passes US$100 million, HEC and TOR gain traction. |

| May 2022 | Terra collapse causes US$16.4 million loss. |

| July 6, 2023 | Multichain bridge fails. Hector loses US$8 million. |

| July 15–17, 2023 | Community votes to liquidate treasury. |

| Sept–Dec 2023 | Redemption delays and poor communication frustrate holders. |

| Jan 15–18, 2024 | Hack drains US$2.7 million during redemption. |

| Feb 19, 2024 | Court appoints receivers to manage the remaining assets. |

| June 2024 | Hector files for Chapter 15 bankruptcy in the US. |

Lessons for investors

Here’s what investors should take away, especially if you’re looking at projects like Hector or similar DeFi experiments.

If a protocol has external dependencies such as bridges or oracles, failures in those systems can bring it down. Audits and security checks are only useful if their recommendations are actually implemented, and simpler code often means fewer risks. Governance matters too. Who controls the keys? Who can make changes? A project calling itself a DAO (Decentralized Autonomous Organization) does not guarantee fair decision-making.

Redemption or liquidation needs to be fast and transparent. When it drags on, trust evaporates and lawsuits begin. And when projects operate across borders, the legal side can get messy very quickly.

Finally, token values can collapse almost completely. The HEC token reportedly lost about 99% from its peak.

Hector Network is more than just another DeFi project that failed. It shows how fragile decentralized finance can be, how important governance and communication are, and how risky external dependencies can become. For anyone investing in crypto, its story is a warning sign.

Always ask yourself: Who holds the keys? What happens if the external infrastructure fails? What if something breaks? Because when it does, you’ll want more than just hope!

Note: This article is based on publicly available news reports and coverage of Hector Network’s activities, treasury, and legal proceedings. It is provided for informational purposes only and should not be considered financial or legal advice.

With over five years of experience in the tech industry, Kazim excels at simplifying complex topics, making them accessible to tech enthusiasts and general readers alike.

He has contributed to several renowned publications worldwide, including WindowsReport and Allthings.how, bringing insightful coverage of key developments in the field.

When he’s not writing, you’ll find Kazim planning weekend getaways or diving into tech verticals beyond his expertise.