I still remember the first time I used Bitcoin. It was early 2018. A Redditor was selling a rare gadget I’d been searching for, but only accepted Bitcoin. I had no idea how it worked, but after a couple of YouTube videos and a Coinbase signup, I managed to buy my first 0.01 BTC. Within minutes, the payment was confirmed, and the deal was done. No bank, no paperwork, no delays.

That moment made me question everything I knew about money. Why do we need banks? Why are we tied to paper currency issued by governments? And why does one method feel so outdated while the other feels futuristic?

If you’re wondering the same, you’re not alone. This article is for anyone who’s trying to understand the difference between crypto and fiat currency, how each works, and which might be a better fit in today’s fast-changing world.

What exactly is fiat and crypto?

– Fiat currency explained simply

Fiat currency is the traditional money you use every day. Think of INR, USD, EUR, and so on. It’s issued by governments and regulated by central banks. It has no intrinsic value; its worth comes from the trust people have in the system backing it.

Common examples:

- Indian Rupee (INR)

- US Dollar (USD)

- Euro (EUR)

- Japanese Yen (JPY)

You can hold it physically (notes and coins) or digitally in your bank account.

– Crypto is a different kind of money

Cryptocurrency is digital money that exists only online. It’s powered by a technology called blockchain, which keeps a secure record of every transaction across many computers.

The most popular ones:

- Bitcoin (BTC): The first and most valuable.

- Ethereum (ETH): Known for smart contracts and dApps.

- Solana, Ripple, Dogecoin, etc.: Each with unique features.

No single company or government controls it. That’s the key difference.

Key differences: Crypto vs Fiat Currency

To keep things simple, here’s a quick comparison table:

| Feature | Crypto | Fiat Currency |

|---|---|---|

| Control | Decentralized (peer-to-peer) | Centralized (governments) |

| Form | Digital only | Physical and digital |

| Transaction Speed | Fast (minutes) | Slower (especially cross-border) |

| Inflation Risk | Often limited supply (e.g., BTC) | Unlimited printing possible |

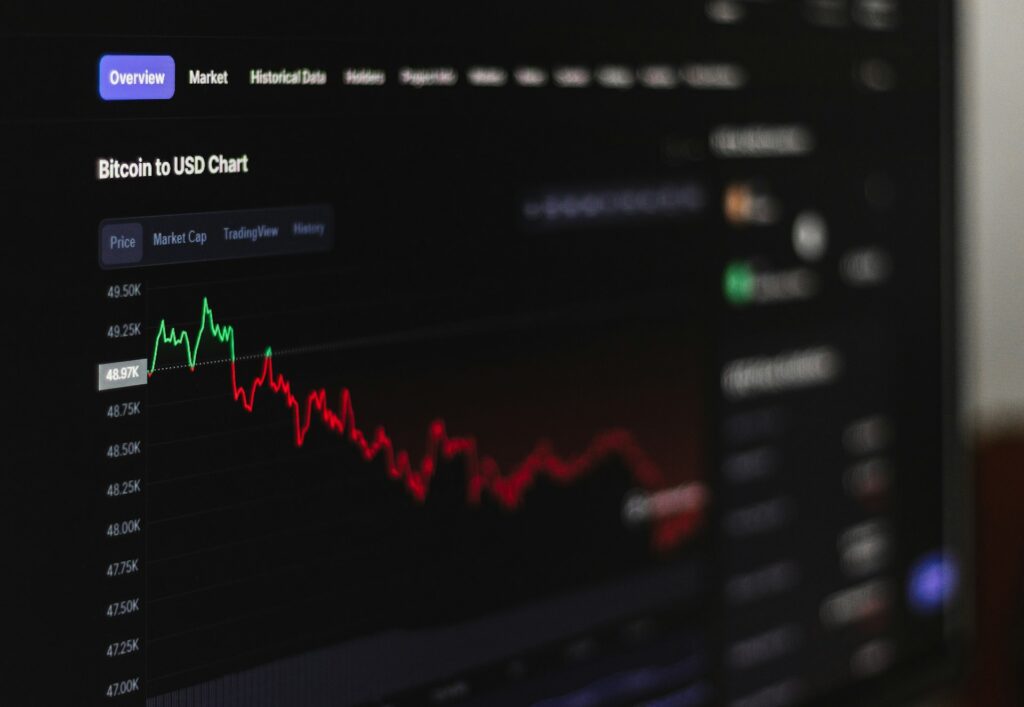

| Stability | Highly volatile | Generally stable |

| Privacy | Pseudonymous | Transparent to authorities |

| Acceptance | Limited but growing | Universally accepted |

Pros and cons of both currencies

Why fiat still rules the world (for now)?

Fiat money has been around for centuries. It’s deeply embedded in how our economies function.

| Pros of fiat: | Cons of fiat: |

| Widely accepted globally | Inflation risk due to overprinting |

| Backed by government trust | Limited privacy (banks track every transaction) |

| Used for paying taxes, salaries, and loans | International transfers are slow and expensive |

| Relatively stable in value (in strong economies) | Controlled by central banks that can change rules anytime |

Why is crypto gaining momentum?

Cryptocurrencies offer something fiat can’t: freedom from intermediaries.

| Pros of crypto: | Cons of crypto: |

| Fast, low-cost international transactions | Price volatility (your $100 today could be $60 tomorrow) |

| Greater privacy and user control | Not widely accepted for daily purchases |

| Deflationary models (like Bitcoin’s limited supply) | Regulatory uncertainty in many countries |

| Can be used without a bank account (ideal for the unbanked) | Irreversible transactions (send to the wrong address = gone) |

One user on Quora mentioned how their $1,000 wire transfer to a family member overseas took 5 business days and cost $45 in fees. That’s where crypto offers a better solution. On the other hand, a Reddit user shared how they accidentally sent ETH to the wrong wallet and lost $500. That’s the kind of thing that doesn’t happen with banks, which offer more safety nets.

So, there are upsides and downsides to both crypto and fiat!

Real-world uses: When to use what?

Crypto shines in global use and privacy

Here are some scenarios where crypto makes more sense:

- Remittances: Sending money abroad quickly without paying high fees.

- Online purchases: Buying NFTs, digital art, or services anonymously.

- Store of value: Many see Bitcoin as “digital gold” against inflation.

- Escaping economic collapse: In countries like Venezuela or Zimbabwe, people turned to crypto to preserve their savings.

Fiat still wins in daily life

That said, fiat isn’t going anywhere soon. You still need it for:

- Paying rent, bills, and groceries

- Receiving salaries

- Taking out loans or mortgages

- Filing taxes

Fiat is trusted (but heavily controlled)

Governments regulate fiat. Banks are insured. If your card is stolen, you can dispute the charge. There’s an established legal system protecting users.

But the downside? Governments can freeze accounts, track your transactions, or even print more money, reducing your purchasing power.

Crypto is free (but your risk is higher)

With crypto, you are the bank. You control your wallet. No one can freeze your account. But if you lose your keys or fall for a scam, there’s no one to help you. This independence is both a strength and a danger.

As one Redditor put it: “Crypto makes you responsible for your own money, and mistakes.”

What about taxes?

Ah, yes, the part no one likes!

Fiat and taxes

With fiat, it’s simple. You earn, you pay income tax. Your bank keeps records, and you file returns.

Crypto and taxes

Crypto is newer, and tax rules vary by country. But most governments now treat it as an asset. That means:

- You may owe capital gains tax if you sell at a profit.

- You need to keep track of buys, sells, swaps, and even rewards (like staking).

- In India, for example, there’s a flat 30% tax on crypto gains, plus 1% TDS.

So yeah, don’t forget to report your crypto trades!

Is crypto replacing fiat?

Let’s be honest. Crypto won’t completely replace fiat anytime soon. But it is changing the way we think about money. Some countries are already exploring Central Bank Digital Currencies (CBDCs), a kind of digital fiat. Others, like El Salvador, have adopted Bitcoin as legal tender.

What’s more likely is a hybrid model, where both fiat and crypto coexist!

We may use:

- Fiat for daily transactions

- Crypto for savings, global transfers, and investments

In fact, many now use Bitcoin to pay for some freelance services and accept payments in USDT (a stablecoin). It’s faster, cheaper, and doesn’t require chasing clients for bank wire details.

Use both smartly and safely

The debate of crypto vs fiat currency isn’t about picking one side. It’s about understanding the strengths and weaknesses of both.

Fiat is stable, regulated, and accepted everywhere, but slow and prone to inflation. Crypto is fast, private, and empowering, but risky and still growing.

So what should you do?

- Use fiat for your regular expenses, savings, and official needs.

- Use crypto for international payments, long-term investment, or as an inflation hedge.

And remember, no matter what you use, never invest or spend more than you can afford to lose, especially with crypto!

With over five years of experience in the tech industry, Kazim excels at simplifying complex topics, making them accessible to tech enthusiasts and general readers alike.

He has contributed to several renowned publications worldwide, including WindowsReport and Allthings.how, bringing insightful coverage of key developments in the field.

When he’s not writing, you’ll find Kazim planning weekend getaways or diving into tech verticals beyond his expertise.