Cryptocurrency staking has gained significant attention in recent years as an alternative to traditional investing methods. But is staking crypto safe?

This blog explores the intricacies of crypto staking, the associated risks, and whether it’s a viable long-term investment strategy.

Understanding crypto staking

Crypto staking involves locking up a portion of your cryptocurrency in a wallet to support the operations of a blockchain network. In return, you earn rewards, typically in the form of additional tokens.

This process is integral to Proof of Stake (PoS) and its variations, which serve as alternatives to the energy-intensive Proof of Work (PoW) used by Bitcoin.

How does crypto staking work?

When you stake your crypto, you are essentially participating in the validation of transactions on the blockchain.

Stakers are chosen to validate transactions and secure the network based on the number of coins they hold and are willing to lock up as collateral. This process helps maintain the integrity and security of the blockchain while offering stakers a way to earn passive income.

Pros and cons of staking cryptocurrency in 2025

| Pros | Cons |

| 1. Passive income: Earn passive income by simply holding and staking your assets. This can be particularly attractive for long-term investors looking to maximize their holdings. | 1. Price volatility: The same volatility that presents an opportunity for gains also poses a risk for losses. A significant drop in the value of the staked asset can offset the rewards earned from staking. |

| 2. Network participation: By staking, you contribute to the security and decentralization of the blockchain network. This active participation can also foster a deeper understanding of the technology and its potential. | 2. Opportunity cost: Locking up funds in staking means they cannot be used for other potentially lucrative opportunities. This opportunity cost can be significant in a market known for its rapid innovation and frequent emergence of new investment opportunities. |

| 3. Incentives and rewards: Staking rewards can be lucrative, especially for early adopters of new or emerging blockchain projects. The annual percentage yield (APY) can vary significantly, with some projects offering double-digit returns. | 3. Inflationary risks: Some staking rewards come from newly minted coins, which can lead to inflation. This inflation can erode the value of the rewards if the increase in supply outpaces demand. |

What are the risks in staking crypto?

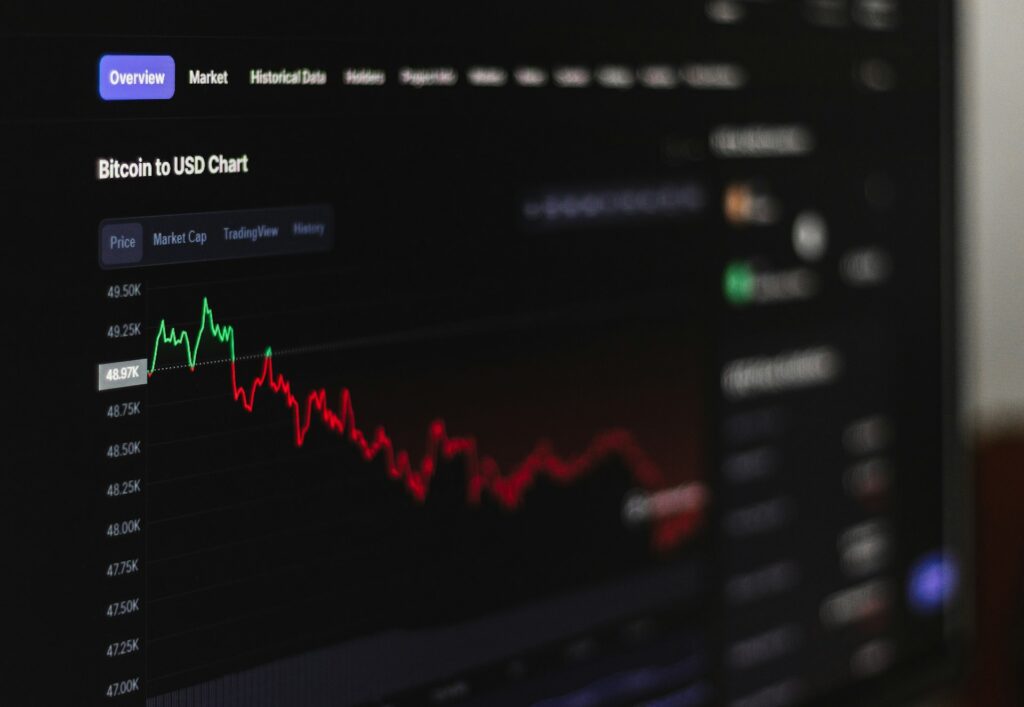

1. Market risk

Cryptocurrencies are notoriously volatile. The value of the staked coins can decrease significantly during the staking period, leading to substantial financial losses. For example, if you stake $10,000 worth of a particular cryptocurrency and its value drops by 50%, your staked amount is now worth only $5,000.

Market volatility is one of the key reasons experts recommend against crypto investments.

2. Lock-up periods

Many staking protocols require a lock-up period during which you cannot access or sell your staked coins. This lack of liquidity can be a significant risk, especially in a rapidly changing market where the ability to react quickly is crucial.

3. Validator risks

Staking involves delegating your coins to a validator or becoming one yourself. If the validator acts maliciously or is penalized for improper behaviour, you might lose a portion of your staked assets. This is known as slashing, a process where a portion of staked tokens is taken away as a penalty for misbehaviour.

4. Technical risks

Running a validator node requires technical knowledge and a secure setup. Failures such as hardware malfunctions, software bugs, or cyber attacks can result in losses of staked funds.

5. Regulatory risks

The regulatory landscape for cryptocurrencies is constantly evolving. Changes in regulations can impact the legality and profitability of staking activities. For instance, new laws might restrict or tax staking rewards, diminishing the anticipated returns.

Is staking better than holding in crypto?

When comparing staking to simply holding (or HODLing) cryptocurrencies, several factors come into play. Let’s understand the advantages and disadvantages:

| Advantages | Disadvantages |

| 1. Earning rewards: Staking provides an opportunity to earn rewards on your holdings, whereas holding offers no direct financial benefits. | 1. Reduced liquidity: Staking typically requires locking up funds, limiting your ability to quickly react to market changes. |

| 2. Support network security: Staking helps maintain and secure the network, contributing to its overall health and sustainability. | 2. Increased risk: The potential for slashing and other validator-related risks are unique to staking and do not affect holding. |

Is staking crypto halal?

The question of whether staking crypto is halal (permissible under Islamic law) is complex and varies depending on interpretations of Sharia law.

Generally, the permissibility hinges on whether staking is considered a form of interest (riba), which is prohibited, or if it is seen as a profit-sharing mechanism, which is allowed.

Consulting with knowledgeable Islamic scholars who understand both the principles of Sharia and the technical aspects of crypto staking is advisable.

Crypto staking offers a safe and promising way to earn passive income and support blockchain networks, but it is not without its risks. Understanding these risks and weighing them against potential rewards is crucial for anyone considering staking as a long-term investment.

Whether staking is better than holding and if it aligns with your investment strategy and risk tolerance will ultimately depend on the circumstances and market conditions. So, you must actively monitor the market and reserve only a part of your crypto holdings for staking!

With over five years of experience in the tech industry, Kazim excels at simplifying complex topics, making them accessible to tech enthusiasts and general readers alike. He has contributed to several renowned publications worldwide, including WindowsReport and Allthings.how, bringing insightful coverage of key developments in the field.

When he’s not writing, you’ll find Kazim planning weekend getaways or diving into tech verticals beyond his expertise.

Comments are closed.