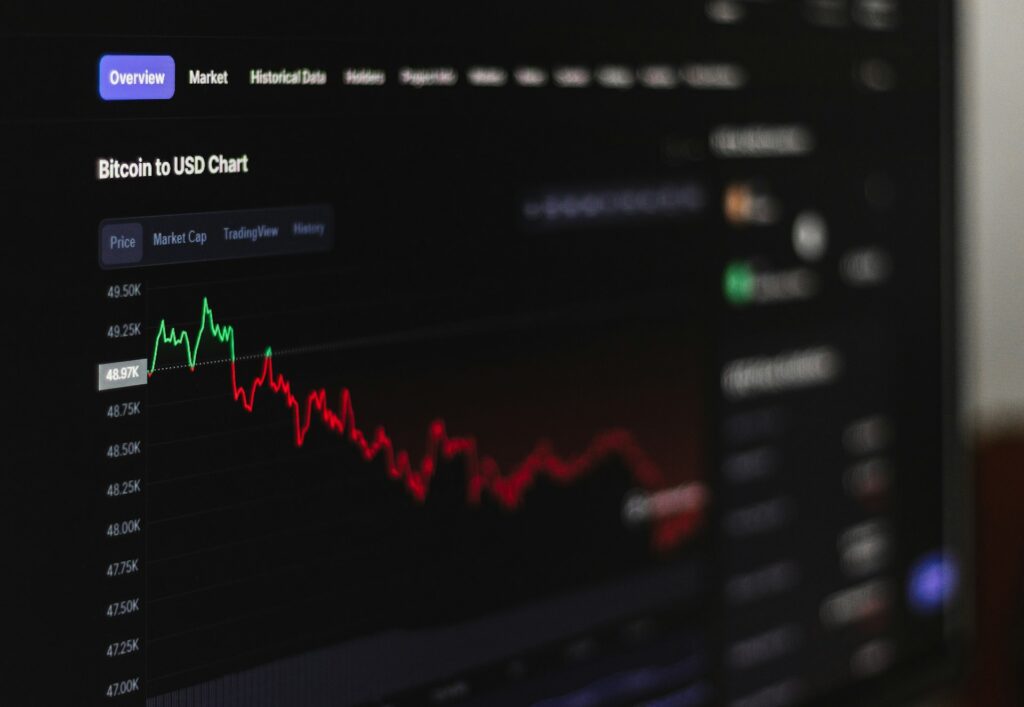

The cryptocurrency market is notorious for its volatility, making effective crypto asset protection essential for investors. With frequent price swings, safeguarding your digital assets against sudden downturns and market fluctuations becomes crucial!

Implementing strategies such as diversifying holdings and staying informed about market trends can mitigate risks. This allows you to enhance resilience against the unpredictable nature of cryptocurrency markets.

How do I beat market volatility in crypto?

1. Diversification of assets

Spreading investments across a variety of cryptocurrencies and other asset classes helps mitigate risk. Consider allocating a portion of your portfolio to stablecoins, which are less susceptible to market fluctuations, as their values are pegged to traditional currencies or commodities.

2. Use stop-loss orders

Implementing stop-loss orders can help limit losses during sudden market downturns. By setting predetermined prices at which assets will be sold, investors can protect their portfolios from further declines.

For instance, a trailing stop-loss adjusts automatically to market gains, allowing you to secure profits while minimizing potential losses.

3. Explore options trading

Utilizing put options allows investors to sell assets at a predetermined price within a specified time. This strategy can be particularly effective during downturns; for example, if you own a put option for Bitcoin at $50,000 and the price drops below that, you can still sell at the higher price.

4. Employ risk management tools

Platforms like Bumper provide unique hedging solutions that protect against price declines. By purchasing a protection plan, investors can set a “floor” price for their assets, ensuring they won’t fall below a certain value.

5. Stay informed with market analysis

Regularly reviewing market trends and news can help you make informed decisions. Following analysts and subscribing to financial news platforms can provide insights into potential market movements and shifts, allowing for timely adjustments in your portfolio.

6. Set realistic investment goals

Establishing clear objectives based on your risk tolerance and investment horizon can guide your trading strategies. Whether you’re a long-term holder or an active trader, having defined goals can help manage your expectations and reduce emotional trading.

7. Limit leverage usage

While leverage can amplify gains, it also increases the risk of significant losses. Keeping leverage low, or avoiding it altogether, can prevent margin calls and liquidations during market downturns, protecting your capital.

8. Regularly rebalance your portfolio

Adjusting your portfolio periodically to reflect market conditions and asset performance helps maintain your desired risk level. This might involve selling off overperforming assets and reinvesting in underperforming ones to ensure a balanced approach.

9. Utilize dollar-cost averaging

This strategy involves investing a fixed amount of money at regular intervals, regardless of market conditions. By doing so, you can average out the purchase price of your assets over time, reducing the impact of market volatility on your overall investment.

Market volatility poses a significant risk to cryptocurrency investors, often leading to drastic losses after seemingly minor events.

For instance, in August 2024, Ethereum plummeted over 25% following regulatory announcements that rattled investor confidence. Similarly, Bitcoin experienced sharp declines after a rumored government crackdown on digital assets. These examples underscore the unpredictable nature of the crypto market and the importance of implementing protective strategies.

By diversifying portfolios and utilizing risk management tools, investors can safeguard their assets against sudden market swings, ensuring greater resilience in an ever-changing financial landscape.

Also, if you plan to give up active trading, consider employing methods that deliver passive income from cryptocurrency holdings.