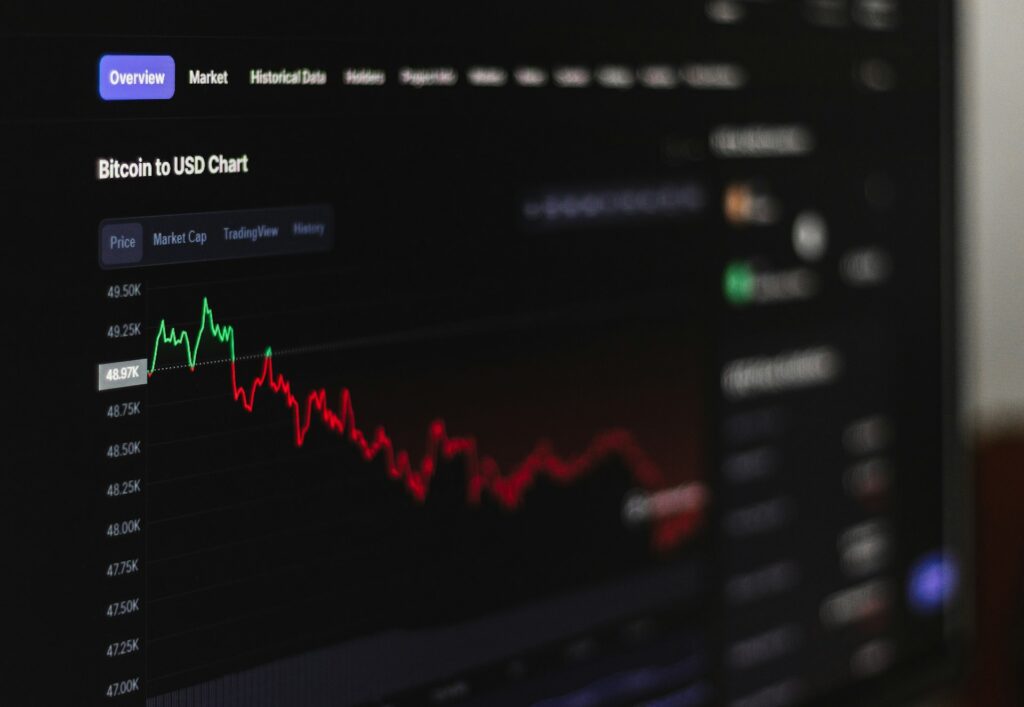

Cryptocurrency markets are notoriously volatile, driven by factors like regulatory uncertainty, market sentiment, and the influence of large holders, or “Whales.” Unlike traditional markets, crypto lacks regulatory oversight, making it more prone to manipulation and rapid price swings!

External influences, such as news, social media, and technological breakthroughs, can cause significant fluctuations. For instance, Elon Musk’s tweets have famously affected Bitcoin’s price.

Additionally, the speculative nature of crypto fuels further volatility, with prices reacting to events like government crackdowns or economic crises. This unpredictability offers both risks and opportunities for investors willing to navigate the turbulence.

Why is the cryptocurrency market so volatile?

1. Market sentiment

Cryptocurrency prices are heavily influenced by investor sentiment, which can shift rapidly due to news, social media trends, or market events. For example, in July 2024, Bitcoin’s price surged following positive regulatory news about spot Bitcoin exchange-traded funds (ETFs), reflecting how sentiment can drive significant price movements.

2. Regulatory news

Changes in regulations can dramatically impact prices. In March 2024, the U.S. SEC’s decision on a spot Ethereum ETF led to a 30% price increase for Ethereum, demonstrating how regulatory developments can lead to sharp price fluctuations.

3. Technological developments

Upgrades and improvements in blockchain technology can affect prices. The Dencun Upgrade for Ethereum in early 2024 resulted in a notable increase in its value, as traders anticipated enhanced scalability and lower transaction fees.

4. Market manipulation

The relatively small market cap of many cryptocurrencies makes them susceptible to manipulation. Incidents of “pump and dump” schemes continue to emerge; for instance, in early 2024, the price of the lesser-known coin ORDI skyrocketed due to coordinated buying efforts before crashing again shortly after.

5. Economic factors

Macroeconomic trends, such as inflation and interest rates, can influence crypto prices. For instance, the U.S. Federal Reserve’s policy changes in 2023 led to fluctuations in Bitcoin’s price, which is often seen as a hedge against inflation.

6. Supply and demand dynamics

The dynamics of supply and demand are crucial in crypto. The upcoming Bitcoin halving in 2024, which will reduce the rate of new Bitcoin production, historically leads to price surges as scarcity increases.

7. Media influence

Media coverage can swing investor interest dramatically. After mainstream media reported on the surge in meme coins in early 2024, prices of coins like Shiba Inu and Dogecoin saw a resurgence, demonstrating how media can affect trading behavior.

8. Exchange issues

Problems with major exchanges can lead to market volatility. In late 2023, the temporary outage of a major exchange led to panic selling, causing significant price drops across multiple cryptocurrencies.

9. Whales and large investors

Large holders, known as “Whales,” can impact market prices through their trading actions. For instance, in February 2024, a single whale’s sell-off caused Ethereum’s price to drop by 20%, showcasing the impact of large investors on the market.

10. Global events

Global events, such as geopolitical tensions or economic crises, can lead to increased volatility. In March 2024, the escalation of conflict in Eastern Europe resulted in a sudden drop in Bitcoin prices as investors sought to liquidate their holdings amid uncertainty.

All these reasons are often cited by experts when explaining why not to invest in cryptocurrency!

Which crypto is most volatile?

Almost all cryptocurrencies exhibit a certain level of volatility, even the most popular ones that command a significant market share, and it’s often tricky to make future predictions.

To illustrate this, here’s a comparison of the prices for Bitcoin (BTC), Ethereum (ETH), and Cardano (ADA) from October 13, 2023, to today, October 13, 2024:

Bitcoin (BTC)

- October 13, 2023: Bitcoin was trading at approximately $27,019.

- October 13, 2024: As of today, Bitcoin is priced around $62,000.

- Price change: This represents a 129% increase over the past year.

Ethereum (ETH)

- October 13, 2023: Ethereum was valued at about $1,638.

- October 13, 2024: The current price of Ethereum is around $2,457.47.

- Price change: This is an increase of approximately 50%.

Cardano (ADA)

- October 13, 2023: Cardano’s price was about $0.28.

- October 13, 2024: Today, Cardano is priced at approximately $0.3513.

- Price change: This marks a 25% increase over the year.

In conclusion, understanding market volatility is essential for anyone considering investing in cryptocurrencies. The digital currency landscape is characterized by rapid price fluctuations influenced by various factors, including market sentiment, regulatory changes, and macroeconomic trends.

Investors must recognize that while volatility can present opportunities for substantial gains, it also carries significant risks. Being informed and developing a robust investment strategy can help mitigate potential losses and lead to more stable investment outcomes in this unpredictable market.

If you are looking for alternate investment options in the blockchain domain, NFTs would be a great choice. NFTs, in 2024, have witnessed a significant revival as the market is shifting towards more practical applications. Besides, you can always earn passive income from NFTs!