Remember the excitement when Clubhouse burst onto the scene in early 2020? This social audio platform took off during the pandemic, offering a unique space for live conversations. Its exclusive invite-only model drew in everyone from celebrities to everyday users, creating a vibrant community that thrived on spontaneous discussions.

At its peak, Clubhouse was valued at a whopping $4 billion and had millions of active users, becoming a standout in the social media landscape.

But then, things started to change. As the world reopened, competition ramped up. Platforms like Twitter Spaces and Facebook Live Audio Rooms began offering similar features, making it harder for Clubhouse to hold its ground.

By 2023, the buzz had significantly quieted down, leading to layoffs and a sharp drop in user engagement.

So, what really led to Clubhouse’s decline? And is there still a chance for it to make a comeback? Let’s dive in, explore this intriguing story together, and find out whether Clubhouse is dead in 2024!

What led to the decline of Clubhouse?

After its meteoric rise, Clubhouse gradually lost momentum as the pandemic waned and new competitors entered the audio space. For many users, it wasn’t just about alternative platforms—it was also about usability issues, evolving interests, and platform fatigue.

Here’s a breakdown of reasons why users left Clubhouse:

- Platform fatigue – Users found the always-on, real-time format tiring, making it challenging to stay engaged without structured breaks.

- Too much noise, not enough value – As Clubhouse grew, the content quality began to decline with more repetitive or unfocused conversations that didn’t provide value.

- Lack of discovery options – Users found it difficult to navigate topics or discover new rooms, which made it harder to stay interested long-term.

- Inconsistent moderation – Many users noted inconsistent room moderation, with some conversations devolving into unmoderated chaos or arguments, leading to an unpleasant experience.

- Privacy concerns – Clubhouse was criticized for requiring access to contacts for invites, which raised privacy concerns among users who were uncomfortable with data-sharing policies.

- Competition from established platforms – The launch of Twitter Spaces, Spotify’s Greenroom, and Facebook Live Audio introduced accessible alternatives, reducing the need to use Clubhouse.

- No recorded content – Unlike podcasts, Clubhouse initially didn’t offer recordings for later listening, meaning users had to be present in real-time or miss out, which wasn’t practical for many.

- Invite-only exclusivity faded – The initial invite-only allure faded as the platform opened to everyone, leading some early users to lose interest without the “exclusive” factor.

- Poor monetization options for creators – Many content creators found limited ways to monetize, making it less appealing for long-term content production and community-building.

- Pandemic lifestyle shift – As normalcy resumed post-pandemic, people became less inclined to spend long periods in virtual rooms, preferring real-life connections instead.

Fall in Clubhouse’s users over the year

| Year | Estimated Users | Reasons for Decline |

|---|---|---|

| 2020 | ~600,000 | Invite-only hype fueled growth, but user base was small and growth was initially limited. |

| 2021 | 10+ million (peak) | Success peaked due to pandemic lockdowns; however, competition began with Twitter Spaces and other platforms replicating Clubhouse’s features. |

| 2022 | ~5-6 million | End of exclusivity, users felt novelty wear off; began feeling platform fatigue and inconsistent moderation. |

| 2023 | ~3.5 million | Decline accelerated as users shifted back to in-person activities and criticized lack of content discovery options. |

| 2024 | ~2 million | Recession in user base continues; competition, monetization challenges, and privacy concerns impacted retention. |

Can Clubhouse make a comeback?

The chances of Clubhouse making a comeback and rising from the dead depend on its ability to change and fix the issues that caused its decline.

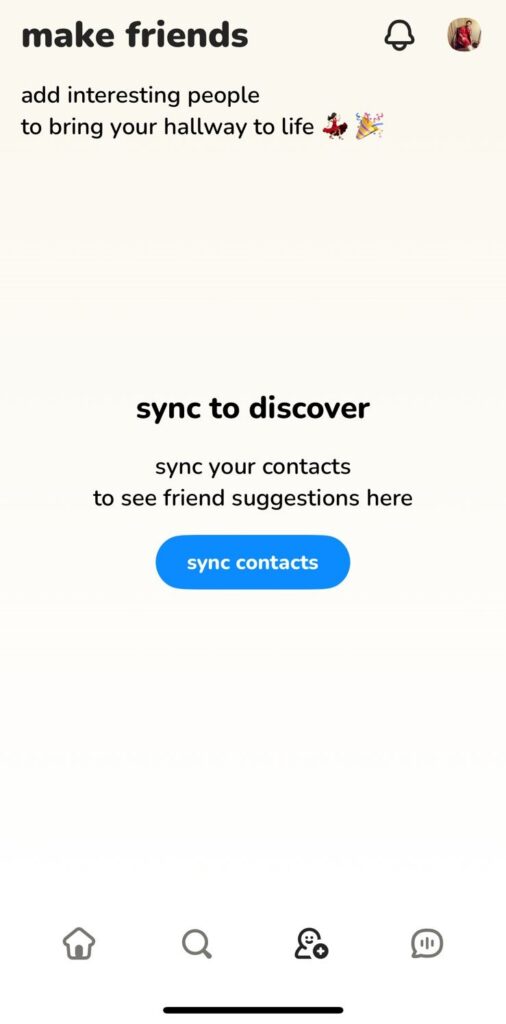

Recently, the platform has moved towards smaller, friend-focused audio chats instead of large public rooms. This change aims to create more meaningful interactions, similar to voice-based networks like Snapchat.

By focusing on these smaller conversations, Clubhouse hopes to bring back interest and improve its previous content quality and moderation problems.

However, the platform still faces tough competition from Twitter Spaces, Spotify’s Greenroom, and Meta’s audio features, all of which offer similar audio experiences. For Clubhouse to stand out, it needs a unique angle and possibly even more significant changes.

Changes that might help Clubhouse make a comeback:

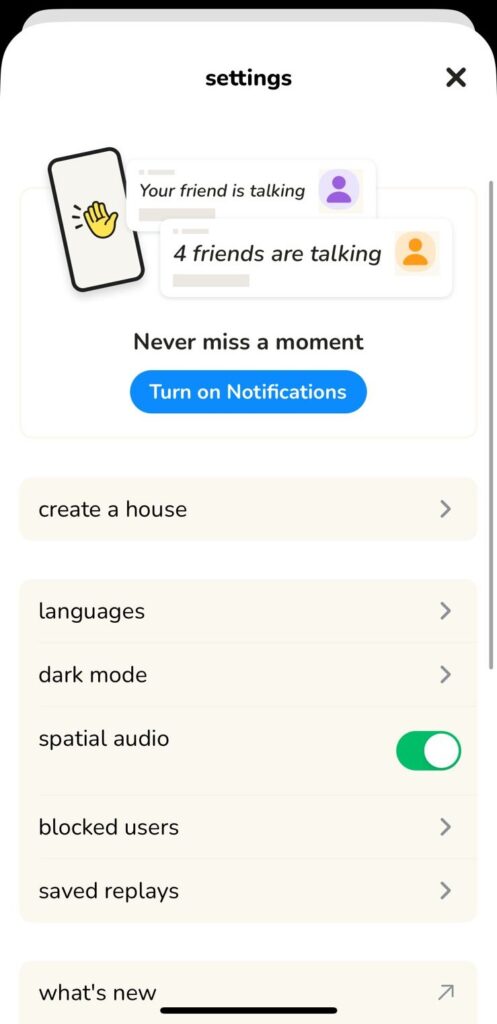

- Enhanced playback options – Improve the replay feature by adding timestamps, summaries, and search options to make it easier for users to find and enjoy past content.

- Improved discovery – Use smart algorithms or user recommendations to help people discover quality rooms and conversations.

- Enhanced monetization options – Create programs that allow content creators to earn money, encouraging them to produce more content.

- Targeted notifications – Reduce notification overload by allowing users to choose what alerts they want to receive.

- Cross-platform integration – Connect with other social media platforms to increase engagement and attract more users.

While Clubhouse may struggle to make a significant comeback due to fierce competition from platforms like Twitter Spaces and Spotify, it’s far from dead in 2024. The current user base is unlikely to abandon the app entirely. Many users have formed genuine connections and even found true love through their interactions on the platform.

At its peak, Clubhouse was a vibrant space for engaging discussions and community building, making it a memorable experience for many. However, with the evolving social media landscape, it remains to be seen if Clubhouse can recapture the magic it once had!

For all social media aficionados out here, discover expert tips to use social media wisely and remain safe from increasing threats and attacks.